As growing numbers of countries identify critical materials within their economies, the ability to recycle them is becoming increasingly important, especially considering both their economic importance and ongoing supply risks. IDTechEx’s report, “Critical Material Recovery 2025-2045: Technologies, Markets, Players” and Advanced Materials and Critical Minerals portfolio, explores the developing technologies enabling this and the sustainability-oriented and economical need for them.

The economic importance and supply risks of critical materials

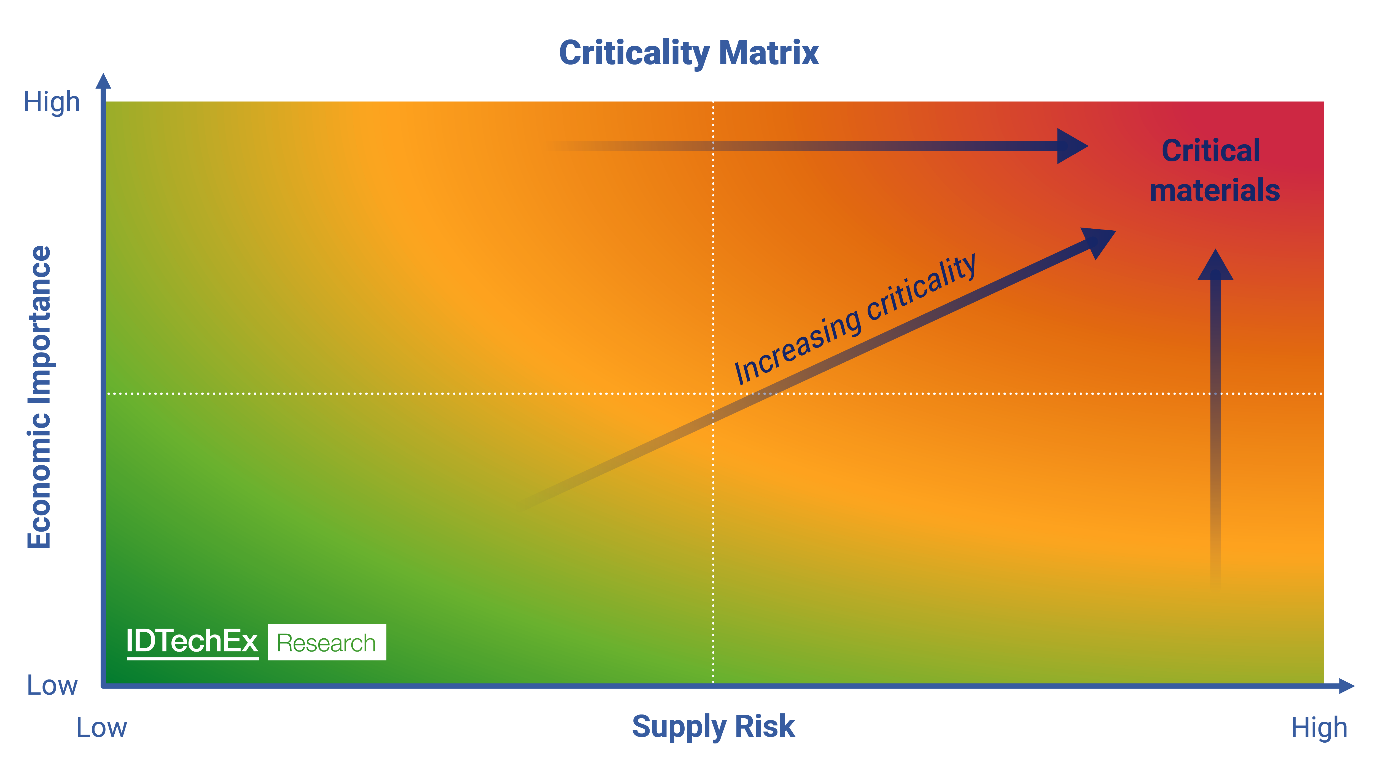

The criticality of rare earth materials can be defined by their supply risk and the uncertainty of their acquisition due to where they are located and processed. Recycling materials from end-of-life products and equipment waste could bring about an increased assurance of availability.

Sustainability goals for various countries rely on growing technology sectors like electric vehicles, which rely on magnets to be manufactured, ultimately meaning sourcing and recycling critical materials is an economic necessity to keep supply chains running. Critical materials, such as rare-earth elements, are crucial components of magnetic materials, with rare-earth permanent magnets being particularly desirable for both the cost and performance of EV motors.

This graph represents the matrix of critical materials, taking into consideration economic importance and supply risk. Source: IDTechEx

Short-loop and long-loop recycling

Short-loop (direct recycling) and long-loop recycling processes refer to the degree to which a material is broken down. In short-loop recycling, materials are recovered as high-value alloys or functional materials, meaning that for their repurposing in the manufacturing of products, less time and cost is necessary.

However, for long-loop processes, including pyrometallurgical and hydrometallurgical, the elements may be completely separated down into isolated salts or compounds, meaning that they can be sold and used for different applications than that from which they came, though they will require much more time and money.

The trade-off therefore lies where the desire for flexibility in selling these recovered metal salts to other sectors meets the desire to spare the time and costs these processes would require. Short-loop and direct recycling technologies offer the most compelling value proposition in critical material markets with consolidating applications – for example, Li-ion batteries and rare-earth permanent magnets are required in decarbonized energy and transport technologies.

EV battery recycling

With significant volumes of EVs expected to reach end of life in the 2030s, their batteries will become key sources for recycling critical lithium, nickel, cobalt and manganese materials found in cathode materials. It is most profitable to recycle NMC, NCA, or LCO Li-ion chemistries, which can make it easier to cover the costs of recycling and ensure no money is lost in the process. IDTechEx reports that OEMs may even charge a fee for recycling other Li-ion batteries such as LFP.

Li-ion batteries are in high demand in several sectors, meaning their recycling is necessary to ensure sustainability goals can be met across these markets. Due to global environmental concerns and the desire for decarbonization, stationary energy storage systems are one of the main application areas driving demand alongside EVs.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/CriticalMaterials.

For the full portfolio of sustainability market research available from IDTechEx, please see www.IDTechEx.com/Research/Sustainability.